Payroll processing is a tedious and time-consuming task. Most business owners still think manually handling the payroll processes is the only way to cut costs and reduce errors. However, businesses can now use payroll software to automate these processes and increase their efficiency.

The best payroll software should handle all your payroll needs, e.g., calculating wages, withholding taxes, making payments to employees, sending annual tax forms, and keeping track of all payroll-related documents. An inefficient system can lead to errors and inconsistencies against the Fair Labor Standards Act (FLSA) and IRS regulations.

As such, you need to find the right payroll software that will streamline your business operations and comply with all federal and state laws. This article will take you through the steps to find the best payroll software.

What Is Payroll Software?

Payroll software allows you to automate all your payroll tasks. This software calculates wages and expenses, withholds taxes, makes payments to employees, submits payroll data to government agencies (e.g., social security), and tracks all documents related to the payroll process.

It cuts down all the administrative, processing, and paperwork burdens of your business. The software is more efficient than traditional manual payroll processing as it provides an automated solution for tracking employees, tax payments, and deductions. It also reduces the risk of human error that could result in fines, penalties, and lawsuits.

Factors to Consider When Choosing a Payroll Software

Before settling on any particular payroll software, make sure you do your research and consider all factors that matter in the long run.

Some critical factors to consider include:

1. Identify Your Payroll Needs

It’s important to understand your business needs and payroll requirements before selecting any software. If you know the details, you can find the right option that meets your specific requirements. To identify your requirements, ask yourself the following questions:

- How many employees do you have?

- In how many states do you operate?

- What payroll services do you require (e.g., processing, tax forms, and reporting)?

- How often will you run payroll?

- Do you need to print out paychecks?

- Is the software web-based or desktop?

- What features will you need to include in your solution?

Once you answer these questions, you’ll better understand the features to look for in payroll software. For instance, if you have many employees, their payroll data will pile up quickly. That’s why it’s important to include features like contact management and employee profiles in the software.

2. Establish Your Payroll Budget

Businesses operate on a budget, and your payroll software needs to align with your budget. As such, set a budget for payroll software and find out how much the solution will cost you per month/year along with any additional fees. If you have many employees, expect to shell out more money every year.

Some companies might offer flexible pricing plans or discounted rates based on your volume of transactions. You should expect to pay anywhere between $20 to several hundred dollars per month, with the most expensive payroll options usually coming with additional services.

Opt for a solution that matches your budget. More importantly, make sure you can comfortably afford the solution if you need to pay more than you expected. The last thing you want is to stick with payroll software that doesn’t work for your business or one that drains your financial resources in the long run.

3. Comply with State/Federal Laws

The best payroll software comes with features that comply with federal and state laws. For instance, some payroll software solutions come with withholding calculators to ensure your business complies with state and federal taxes, such as FICA (federal insurance contribution act) and state unemployment.

The software should also calculate and apply complex payroll deductions and withholdings that comply with federal payroll tax laws. It’s also important for this software to issue precise and accurate pay stubs and tax forms (e.g., W-2 or 1099) to both employees and the IRS.

The software’s reporting feature should provide your business with tax documents like wage statements, retention reports, and summaries to help you stay compliant with state and federal laws. Additionally, make sure you can access all transaction history at any time; otherwise, that might be a deal-breaker.

4. Ensure Ease of Use

When looking for payroll software, always consider ease of use. It should be easy to set up and integrate with the other business applications you’re using. For example, if you’re already using another payroll provider, your new solution needs to sync with that provider seamlessly.

For instance, you might want to switch from a software-as-a-service (SaaS) solution to one that’s web-based. Or, if you need to integrate payroll data with your existing accounting or bookkeeping application, make sure the new tool has an API (application programming interface).

5. Evaluate Support Options

Like any other piece of technology, payroll software sometimes malfunctions. When that happens, you need to know how to get help.

Most payroll software solutions offer live chat and email support to answer your questions. Before investing in a solution, always call customer support and ask how long they’ll typically take to respond. For instance, if their response time is too slow or the wait times are high, find out why.

Additionally, some payroll software might include help videos or step-by-step guides to help you address the most common issues. Some solutions come with training webinars and onsite support for small companies that can’t afford an in-house team of experts.

6. Consider Flexibility

Think about your short-term and long-term business goals. Do you need a payroll solution that scales with your business? Do you intend to grow and expand over the years into different business segments and departments? Or, is this for a small business that has just begun operations and can’t afford to pay too much for payroll software right away?

If your company’s future depends on technology, then consider investing in real-time or cloud-based solutions. These solutions offer more flexibility and scalability than on-premise software.

For instance, cloud-based payroll providers can offer your business access to better tools for managing multiple locations, cross-border payroll services, tax filings, compliance reports, integration with other business applications, and so much more.

7. Data Conversion and Integration

You may already utilize a separate payroll service. To avoid time-consuming manual entry, make sure your new payroll system can seamlessly link with your existing system or, at the very least, export and import data without difficulty.

If your current payroll provider doesn’t offer this, you might need to convert all the data on your own. If so, how difficult is it to transfer payroll information from one system to another? Is it complicated and time-consuming? Do they offer third-party services such as automated conversion software or an API for integration with other applications?

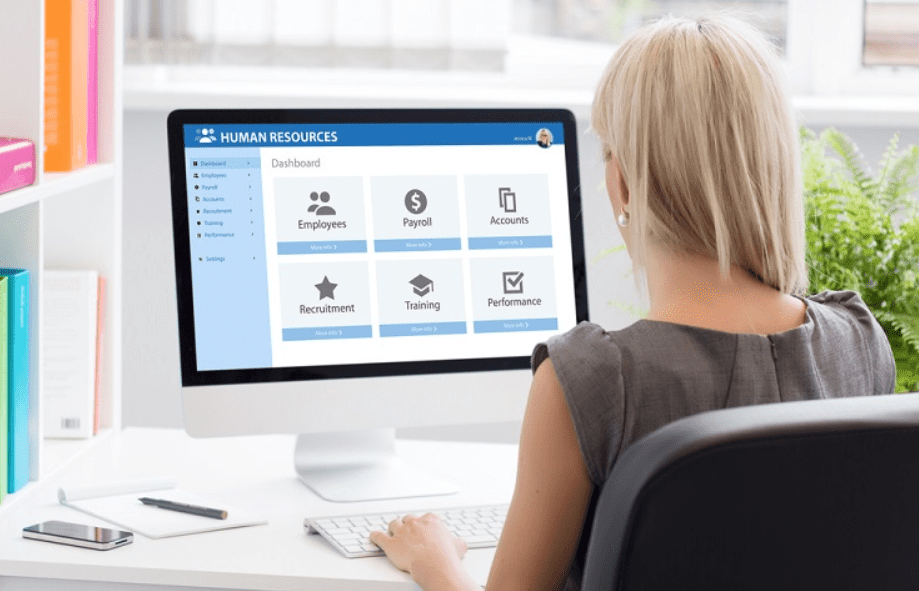

Core Features and Functionalities of the Best Payroll Software

The features and functionalities of a payroll software solution determine its effectiveness and efficiency. Below are several key features to consider when choosing a payroll provider.

1. Employee Self Service

Employees should be able to access their pay stubs, deductions, tax forms, and other payroll-related information without having to go through the HR department or payroll processor.

For instance, the system should automatically generate a personalized login link for each employee and explain what information they’ll find once they log in. The software should offer a mobile app for employees to access their data from anywhere for added convenience.

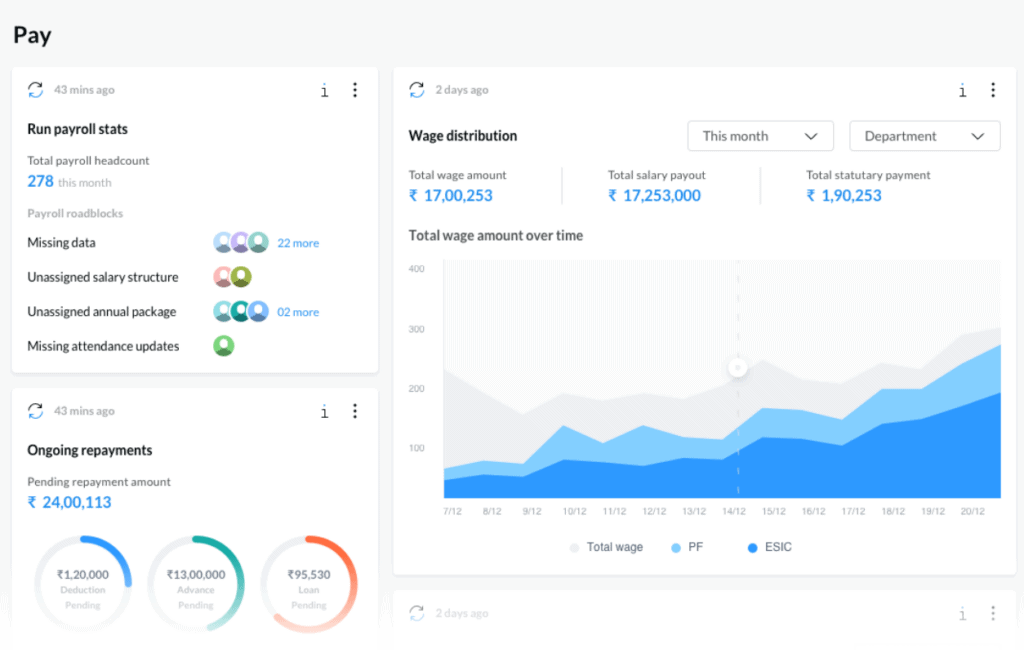

2. Reporting and Analytics

To make informed business decisions, you need real-time reporting tools. The best payroll systems provide detailed reports on all your company’s financial data in one place. It allows you to make certain all your payroll processes align with labor laws and direct deposit requirements.

Reporting tools should include the following:

- Payroll reports (tax filing, expense reimbursement, etc.)

- Time tracking reports (showing how many hours employees worked)

- Successful or unsuccessful direct deposits (for auditing purposes)

- Client management reports (listing all clients for easy reference)

3. Automatic Payroll and Tax Filing

The best payroll solutions automatically calculate your business’s taxes and regulatory requirements, such as minimum wage and overtime pay. It sends out tax forms and other documentation on time so you can easily file your state and federal reports on time.

If possible, it integrates with the rest of your accounting software to ensure accuracy in tax calculations and to prevent mistakes in tax filing. Your employees will have access to their payslips and paystub information, which means your payroll team will no longer have to process timesheets and expense forms by hand.

4. Compliance Tools for Managing Labor Laws

In today’s business world, it’s crucial to stay up-to-date with the latest labor laws. To do this, look for a system that offers integrated compliance tools. For instance, many of the best payroll software providers can help you comply with FMLA (Family and Medical Leave Act).

It should also offer tools that allow you to calculate overtime pay rules, manage worker’s compensation claims, and review all your state-specific HR laws. So whenever there are changes in labor laws, your payroll team can easily keep up with the changes without consulting a third party.

5. Compensation Administration

If your company offers a variety of compensation types, such as salary, piece rates, and commission-based paychecks, you need a solution that integrates all the features into one platform. It should also offer different calculations for each compensation structure.

The software should integrate with your existing HR software or allow employees to log their hours directly into the system. It should also integrate with enterprise-level human capital management (HCM) systems that track employee performance and offer real-time data for faster decision-making.

6. Time, Attendance, and Leave Management

The best payroll software offers an automated time tracking system that replaces paper or spreadsheet-based logs. An integrated or standalone payroll solution should allow you to track and monitor your employees’ hours and timesheets. It should be able to help you manage attendance issues, absence management, and leave requests.

The solutions also integrate with other HR management systems to streamline employee onboarding, automatically update payroll information when employees change positions or departments, offer cross-training capabilities, and give real-time insight into workforce management.

7. Security and Privacy

Payroll and HR data is sensitive, and many businesses don’t trust it with just anyone. The best payroll software should offer complete transparency on its security and privacy policies so you can know who has access to your data at all times.

The solution should also include two-factor authentication (2FA) and encrypts all third-party apps’ user information and data. It should offer a highly customizable permission structure to protect business information from unauthorized access.

8. Direct Deposits and Electronic Payments

One of the most critical features of payroll software is to streamline direct deposit and other payment types, such as electronic payments and pay cards. The best option should allow you to integrate with your bank account without much effort.

It’s also crucial for this solution to be compliant with federal and state laws on electronic payments, such as Check 21 Act and E-SIGN (Electronic Signatures in Global and National Commerce Act). This way, it simplifies financial transactions and payroll calculations while complying with legal requirements.

9. Customization Options

The best payroll software should offer comprehensive services that allow employers to customize the experience fully. It should allow you to easily include all your company’s policies and information, such as compensation types, tax deductions, benefits, and more, in a single system.

For instance, the best payroll software integrates with your existing HR software to store all the company’s records and information into a single database. An optional payroll integration feature lets you pull specific data about your employees, such as address and salary information.

Price vs. Value When Selecting the Best Payroll Software

How do you determine the best value for your business? The best way to compare payroll software is by looking at the total price for what you need, not just one feature or service. Make sure that you understand all of the features offered in each solution and how it will impact your business.

The best payroll software offers both ease-of-use and easy integration with other existing software.

Put together a list of the most important features to you, then determine which software offers the most for your money.

It is crucial to have an easy-to-use payroll system in place for your business, but it’s equally as critical that you don’t spend too much on one solution. Having too many bells and whistles can quickly cause your payroll costs to rise. By limiting the features on a cheaper plan, you can lower your monthly bill and still have a solution that meets your business needs.

The Best Payroll Software to Consider

The best software should offer not just the industry’s most advanced features but also industry-specific additions. If your business is specific to a particular type of industry, you may have additional needs that are not standard in other industries. That’s why it’s critical to find the best payroll software for your company—not just the top HR management solution.

Below is an analysis of the best payroll software options for your company.

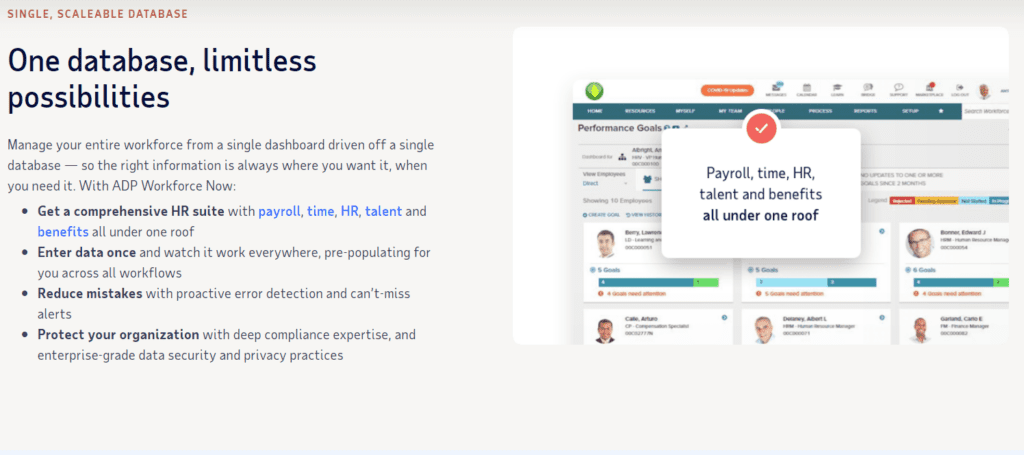

1. ADP Workforce Now: Best for High-Volume Payroll

The best payroll software on the market is ADP Workforce Now. It not only offers a wide range of standard features, but it has specific industry-based capabilities that you can’t find in other HR management solutions.

This cloud-based solution is especially ideal for companies that comply with many state and federal requirements, such as those catering to construction, transportation, financial services, and more.

In addition to highly customizable timesheet options, ADP Workforce Now also has a Leave Management feature that helps companies manage leave requests and scheduling for full-time, part-time, and hourly employees.

The payroll module in ADP is a comprehensive solution that helps you manage your payroll and tax payments in real-time. Its automated features, such as direct deposit, electronic filing capabilities with the IRS, state taxing agencies, and social security administration, contribute to its reputation as one of the best payroll software solutions available on the market today.

Features

- Payroll processing

- Tax filings

- performance management

- Compensation management

- Reporting

- Analytics

- Labor management

Pricing

- $59 per month + $4 per employee per month

Pros

- Cloud-based solutions

- Reliable support

- Data-driven insights

- Easy tax filing and payroll processing

Cons

- Doesn’t disclose prices online

- Hidden fees

- It doesn’t integrate with some software like QuickBooks

2. Gusto: Best for Small and Midsized Businesses

Gusto is another top payroll software that combines human-like artificial intelligence (AI) with customizability to create an affordable solution for small and large businesses.

As a cloud-based payroll software, Gusto offers an easy-to-use interface. It can save you money with its advanced automation features and the advantage of being a completely paperless solution.

Gusto comes with a contractor-only plan for businesses that only need to manage freelance and contract workers. This plan makes it one of the best payroll software for small business owners.

You don’t have to sign any contracts with Gusto as you have to pay monthly. Its “No Contract” plan allows you to choose the features your business needs and only pay for the services. Gusto is an excellent solution for small businesses with a dedicated HR department or in-house payroll specialists with its simple, transparent pricing structure.

Features

- Payroll processing

- Payment options

- Payroll taxes

- Employee types

- Integrations

- HR services

- Year-end forms

Pricing

- $39 per month + $6 per person

Pros

- Simple to use

- Faster

- Employee self-service

- All HR tools are available

Cons

- Slightly expensive

3. Paychex: Best for Reporting and Filings

Another leader in the payroll industry is Paychex. Its solution is an excellent option for any company looking for HR management software with comprehensive features and a simple user interface.

With more than 160 reports you get with the payroll solution, you’ll have no trouble analyzing the data and identifying where you need to make adjustments. File your federal and state payroll forms with Paychex along with employees’ quarterly tax payments.

Features

- Direct deposit

- Tax administration

- General ledger report

- Standard analytics and reporting

- HR library and business forms

- New hire reporting

Pricing

- $39/mo + $5 per employee

Pros

- Easy to use

- 24/7 support

- Extensive reporting features

Cons

- Hidden fees

4. QuickBooks: Best for Businesses that Use QuickBooks

Most businesses use QuickBooks for their bookkeeping needs. Integrating payroll with QuickBooks is a reasonably straightforward process.

QuickBooks payroll offers some best practices for managing payroll in QuickBooks, like automatically transferring your point-of-sale (POS) data to help you avoid costly mistakes when paying employees.

With its extensive payroll features, it’s a bit limited when it comes to HR management. The payroll solution doesn’t offer the same feature-rich functionality that you get with Gusto and ADP Payroll. Still, its user-friendly interface, extensive reporting features, and connection to QuickBooks are enough for many businesses.

Features

- Run reports

- Send estimates

- Track sales

- Track income and expenses

- Tax deductions

Pricing

- Core: $13.50/month + $4 per employee per month

- Premium: $22.50/month +$8 per employee per month

- Elite: $37.50/month+$10 per employee per month

Pros

- Automatic payroll

- Accuracy

- Faster direct deposits

- Easy to use

Cons

- Integration is limited without QuickBooks

- Limited features on cheaper plans

5. Payroll 4 Free: Best for Businesses on a Budget

Looking for a great payroll solution that won’t break the bank? Payroll 4 Free is one of the best solutions to consider. It lacks the direct deposit option and other core features such as tax filing unless you are willing to part with low-cost upgrade options. Still, it allows you to run reports on your payroll data in an easy-to-use interface.

For businesses with less than 25 employees, it’s a step up from basic Excel-based solutions. The setup process is manual, but its user-friendly interface makes it easy to walk you through the steps. Payroll 4 Free charges a $15 fee for tax filing and an additional $15 for direct deposit services.

Features

- Tax calculation forms

- Direct deposits

- Vacation time tracking

- Reporting

- Employee portal

Pricing

- Basic features: Free

- Payroll taxes: $15

- Direct deposits: $15

Pros

- Quick and easy to use

- Flexible payment options

- Comprehensive tax tools

Cons

- Limited system compatibility (Only works on windows)

6. Dayforce HCM: Best for Higher-Level Payroll Reports and Analysis

Dayforce HCM is one of the premium payroll software solutions on our list. One of the most notable features it offers is its report builder that allows you to design your forms and reports out of a wide range of pre-set options.

It takes complex payroll calculations and makes them easy to understand with its real-time data calculations. If you’re looking for something more than the standard PDF reports that many of these payroll solutions offer, Dayforce HCM’s report builder is a worthy choice.

Its payroll module automates how you manage your employees’ time, attendance, and payroll. And because it’s cloud-based, the processing is available to you anytime, anywhere that you go.

Features

- Real-time audits

- Employee self-service

- Verification services

- Easy adjustments

- Compliance management

- Continuous calculations

Pros

- Unified HCM suite

- Easy integration with other software

- Mobile app available

- Ease of use and access

Cons

- Some employees find page navigation difficult

Basis of Selection Process

I researched, compared, and evaluated five payroll software companies based on the following criteria:

- Reviews and recommendations

- Technical support

- Online chat availability

- Basic payroll package cost per employee

- Additional costs

- Authority website ratings and reviews

- Top-rated website for further research

- Research findings

The main takeaway from my research is that the more complicated payroll issues get, the more complex solutions you need. You can do payroll tasks like taxes on your own, but you need to rely on software for more advanced functions like reporting.

Other Top Payroll Software Vendors to Consider

When shopping for a payroll solution, the list of solutions to choose from is extensive. Here are some other notable vendors you may want to consider when narrowing down the options.

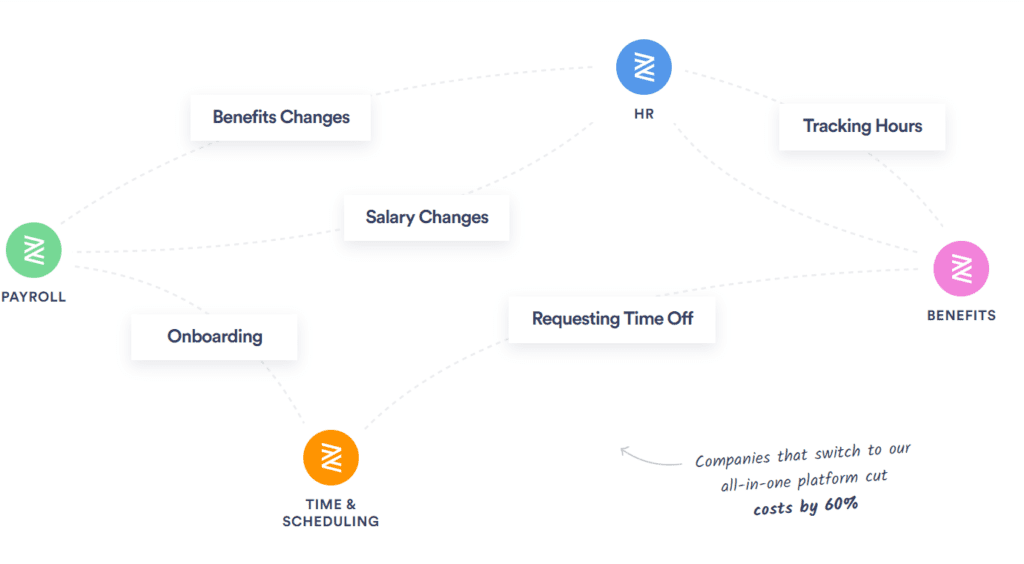

1. Rippling (g2 Rating 4.9/5.0)

Rippling is an all-in-one HR solution that offers payroll, employee portal, time tracking, scheduling, and reporting tools. The interface is easy to navigate and understand. It also provides unique features such as global payroll and bi-directional integration with other payroll software solutions.

2. OnPay (Trustpilot Rating: 4.7/5.0)

OnPay offers an excellent solution for small and medium-sized businesses. It provides features such as employee management, payroll software, and integration with other popular software solutions. It’s cloud-based, which means that you can access it from anywhere with an internet connection. It also integrates easily with other popular solutions such as QuickBooks and Xero.

3. Square Payroll (GetApp Ratings: 4.7/5.0)

Square payroll stands out as an affordable solution for small businesses. You can choose the plan that’s right for you, based on your needs and budget. It comes with an employee access portal that makes it easy for your employees to clock in and out, track historical earnings and update their personal information.

4. Zenefits (g2 Ratings: 4.1/5.0)

Zenefits is a cloud-based solution that helps manage payroll processes for small and midsized businesses. As a comprehensive HR platform, it offers other benefits such as time-off tracking, compliance tools, and recruiting assistance. You can also manage your 401K plans and insurance services through this platform.

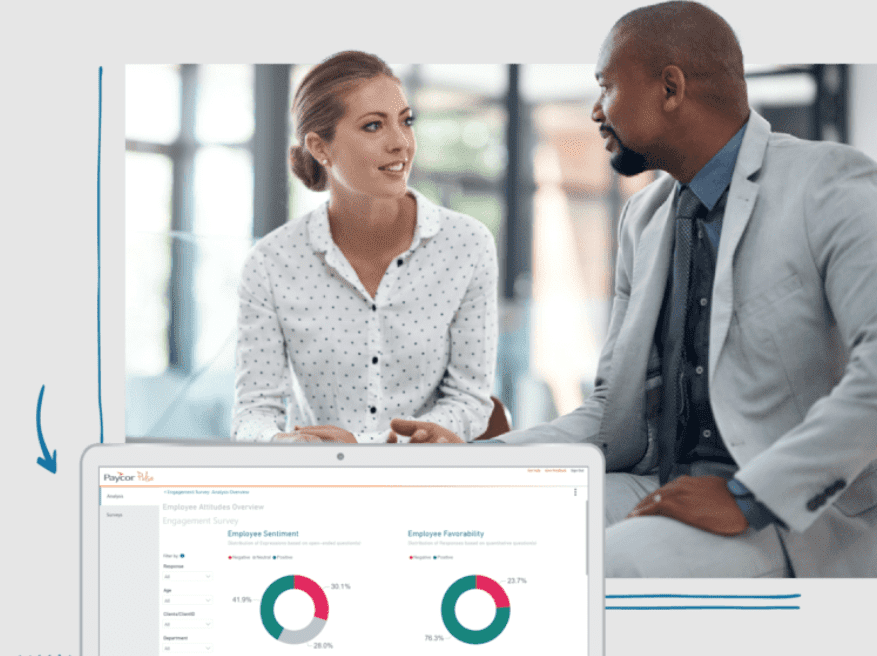

5. Paycor (g2 Ratings: 4.1/5.0)

Paycor is an HCM solution that comes with a twist. It manages everything from recruitment to retirement plans. You can choose the plan that’s right for you based on your current HR management needs. For HR leaders who want to manage multiple departments, focus on strategic goals, and see around corners, Paycor is a good choice.

Emerging Trends in Payroll Management

When searching for the best payroll software, it’s important to consider recent trends. Here are some of the major current developments in payroll management.

1. Greater Focus on Compliance

With a growing number of payroll management regulations, businesses need to have a solution to provide the right compliance tools. These include software, as well as assistance from professionals who understand the compliance landscape.

2. Growth in Mobile Technology

Mobile technology is everywhere, and this includes payroll systems. More and more employees are expecting access to their time cards from a mobile device. An ideal solution should allow employees to clock in and out on their phones and receive real-time alerts about their paychecks.

3. Cloud Computing

As more businesses switch to cloud-based solutions, the demand for cloud-native software is growing. Cloud computing promises flexible access to data, reduced overhead costs, and better security compared with other options. Your ideal payroll software solution should be cloud-based and should provide tools to help you easily move your data to other platforms.

4. Integration with Other Software Solutions

Integration with other software solutions is another significant trend that you need to consider. You should find the right solution that fits into your existing ecosystem. It could mean integration with accounting packages such as QuickBooks or collaboration solutions such as Google Apps.

5. Artificial Intelligence

AI is yet another new development in payroll management. AI-based solutions provide more automation and better insights into your existing data. They also come with more advanced compliance tools to help you identify patterns in your payroll management practices.

6. Security

Security is another concern for HR professionals looking for an ideal payroll software solution. Look out for PCI compliant solutions with proper encryption systems in place, and undergo regular auditing by compliance experts.

How to Find the Best Payroll Software (FAQs)

Answer: The best payroll software is the one that offers what you need at an affordable price. It should also be easy to use and integrate easily with your existing software solutions. Choose a solution that fits your current ecosystem and makes it easy for you to switch from other platforms.

Answer: ADP Workforce Now stands out as the best payroll software based on user recommendations, reviews, and ratings. It comes with a set of smart features ideal for most businesses, including SMBs and large enterprises. Other payroll software options to consider include; Gusto, Paychex flex, Workful, OnPay, and Rippling.

Answer: When looking for the best payroll provider, look for solutions that can provide more than just software. Look for features such as data conversion, integration, employee self-service, customer support, and financial reporting. Ensure that your payroll provider has the tools to help you stay compliant with current regulations.

Answer: Large companies often rely on cloud-based solutions such as ADP Workforce Now, QuickBooks Payroll, Zoho Books, or Gusto to handle their payroll management needs. They also use solutions that offer advanced data analytics to identify potential problems in their existing processes.

Conclusion

Finding the best payroll software will help you keep track of your employees and payroll activities. More than that, it will provide the insights and automation tools to help you streamline your business processes and increase your profitability.

Look out for important features such as security, integration with other business solutions, data analytics, and artificial intelligence. Pay attention to what the market leaders in payroll software have to offer in terms of features, usability, and customer support.

Excellent payroll software should be easy to implement and use. It should also provide you with data automation tools that can help you improve your business’ overall efficiency and profitability.