Professional employer organizations (PEOs) are an important part of today’s business landscape. Businesses of all sizes and industries use PEOs to outsource human resources, benefits, and other administrative functions.

Those working with a PEO can save time and money while receiving more comprehensive services than they could provide independently.

While the benefits of using a PEO are clear, choosing the right PEO for your business can be difficult. There are many PEOs to choose from, and each offers a different set of services and rates. How do you know which PEO is right for your business?

This guide will help you navigate the PEO industry and help you find the best PEO services for your business. We’ll cover all you need to know about PEOs and provide tips for finding the right PEO for your company.

What is a PEO and What Can it Do?

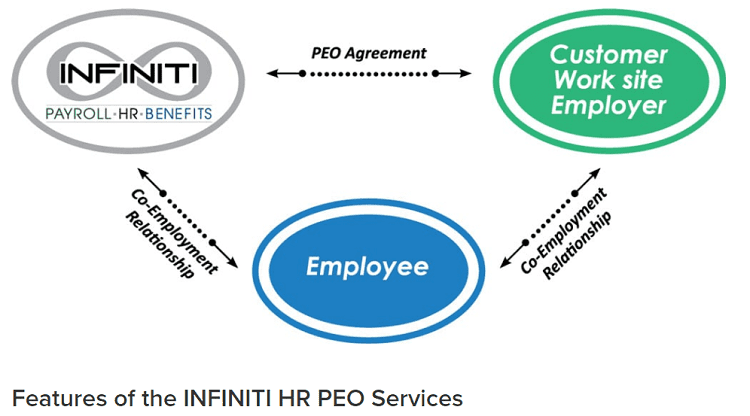

A PEO is a third-party organization that contracts with businesses to provide human resources (HR) and administrative services. PEOs can help businesses of all sizes reduce costs, improve efficiency, and comply with regulations.

All these activities happen through its comprehensive co-employment solution, which allows a PEO to function as an employer of record for federal tax purposes.

The primary advantage of selecting a PEO for a business is providing these services for one flat fee. Small businesses can often afford HR departments, but hiring an in-house HR specialist can be expensive and impractical.

A 2019 report by the National Association of Employer Organizations (NAPEO) indicates that the annual ROI of using PEO services is 27.2% on cost-saving alone.

PEOs also simplify the management of benefits by offering companies flexible options for insurance, retirement plans, paid time off (PTO), and other aspects of employee compensation. Moreover, PEOs don’t necessarily replace an in-house HR staff; they can work alongside your current employees to provide additional support.

Services Provided By PEOs

PEOs provide many services, but the core service that every company needs is HR. Along with providing traditional HR functions like payroll, PEOs also offer employee benefits, workers’ compensation insurance, and compliance assistance.

Below are some of the most common services offered by PEOs.

- Employee benefits

- Talent development

- Risk and compliance management

- Employee recruiting and retention

- Payroll processing

- Time and attendance tracking

- Workers’ compensation insurance

- COBRA administration

When looking for the best PEO, you need to consider how one provides these services. Some PEOs may offer more benefits than others, so it’s crucial to find the right balance of HR and administrative services for your business.

Nonetheless, the services provided by PEOs are invaluable to businesses of all sizes. By outsourcing these functions to a PEO, companies can focus on their core operations and improve their bottom line.

Factors to Consider When Choosing the Best PEO

While finding the best PEO is possible, you need to consider several factors before making your final decision. You should always do your research and check out the PEO carefully before committing to services.

Identify Your Needs

There’s a need to identify what you want from a PEO and how they can help your business grow. Some companies may need a PEO to handle employee benefits and HR functions, while others require timekeeping and payroll services.

Identifying your exact requirements will help you find the best PEO services. For instance, if you have an in-house HR staff, you may not need all the services offered by a PEO. An in-depth assessment of your business and current HR practices will help you determine what PEO services you need.

Industry Accreditation

Dealing with legit PEOs is a must for businesses of all sizes. Two accreditation organizations you can trust are IRS-CPEO and ESAC (Employer Services Assurance Corporation).

These organizations offer a stringent vetting process that only the best PEOs can pass. If the PEO you’re considering doesn’t have accreditation from one of these organizations, you should be cautious about their legitimacy.

Check Reviews

Customer feedback is as important as industry accreditation. You can’t base your decision on one or two reviews; instead, you should look for a PEO with hundreds of positive reviews.

There are several third-party review sites that businesses can find the best PEO services. However, looking at reviews from unbiased sources like Yelp, Google Reviews, and the Better Business Bureau (BBB) is also important.

Level of Technology Used by the PEO

One of the primary reasons businesses opt for PEOs is because they want easier HR administration. Thus, opting for a PEO that offers automated HR services can save your business time and money.

A technology-driven PEO should offer a cloud-based HR system that gives you and your employees access to critical data anytime, anywhere.

It should be able to complete payroll fast, track deductions, generate real-time reports, and provide a secure online platform for employees to access their records. Besides the crucial administrative tasks, the best PEO should be efficient in employee data collection, tracking, and reporting.

Pricing and Contract Terms

The best way to determine whether a PEO is the right fit for your business is by pricing. Ask for a quote from the PEO you’re considering and check that the price is reasonable for your business. Also, make sure there are no hidden costs or extra fees attached to the PEO services.

Compliance Issues

Since PEOs help reduce the risk of business compliance issues, it’s crucial to choose a PEO that complies with IRS rules and regulations. A full-fledged auditor may be required to ensure transparency in operations. Selecting a PEO that meets all tax requirements will boost your business’ credibility.

The PEO’s Insurances

The best PEO should also cover you for employee injuries. This factor not only reduces your business’ insurance expenses but also saves you from unnecessary legal hassles. The best PEO should have errors and omissions (E&O) insurance to protect clients against potential lawsuits.

How to Find a PEO Near You

PEOs are not limited to large businesses. The best PEO services are also available in small towns and cities, helping local businesses grow exponentially. You can find PEOs within your state or even your city.

The best way to find a PEO near you is to use an online directory. These directories have listings of all registered PEOs in the United States. You can filter your search by state, city, or keyword.

Another way to find a PEO is through referrals from other businesses. Ask your colleagues, friends, and business partners if they have any experience with PEOs and what their thoughts are. According to NAPEO, there are 487 PEOs in the United States. You can use its Find a PEO search tool to find a PEO in all 50 states.

Cost of Hiring a PEO Service Provider

PEOs aren’t free, and the cost of hiring one varies by company size, services offered, and other factors. You can request a quote from the PEOs you’re considering to determine the cost of hiring one.

PEO Pricing Models

There are two popular pricing models for PEOs.

- Per-employee per-month flat fee: This pricing model doesn’t tie organizations to employee compensation. Therefore, most organizations will prefer it. It’s also a predictable monthly expense that businesses can budget for. On average, this pricing model costs between $40 and $160 per employee per month.

- Percent of payroll: This pricing model is based on the company’s number of employees and the PEO’s services. It’s also the most common pricing model. Charges can range from 2% to 12% of payroll. Since this pricing model is based on employees, it’s an unpredictable monthly expense for businesses.

Cost vs Value of Hiring a PEO

Hiring a PEO can be expensive. However, it offers enormous returns in the form of increased business productivity and reduced costs. Businesses using PEOs establish value for their clients by improving their ability to retain, motivate, engage and manage employees.

Clients should focus more on the core business and lower any expenses related to administrative work. Through cost-saving strategies, PEOs can help enterprises save up to 27.2% on HR costs. It shouldn’t be a surprise that the cost of hiring a PEO is far lower than these savings.

The best way to decide if it’s worth using a PEO is to calculate the cost of not hiring one. If you were paying for a PEO anyways in terms of time and money, it makes sense to use a PEO instead.

Realizing value from a PEO service provider is an ongoing journey. As your business changes, so will the PEO’s services and solutions. Choose a PEO that provides a breadth of services and is willing to adapt to your specific needs.

The Benefits of Hiring a PEO Service Provider

Reduced costs are an obvious benefit. Besides, PEOs can help your business provide better customer service with cost-effective human resources solutions. However, the real value from a PEO comes from increased productivity and higher return on investment.

Some of the ways a PEO can help your business include:

- Increased productivity: By outsourcing your HR functions to a PEO, you can increase the productivity of your employees. A PEO will take care of all the paperwork and other administrative tasks, allowing your employees to focus on their work.

- Reduced employee turnover: The best PEOs have a comprehensive benefits package that can save your business a lot of money. Since most PEOs have time-saving HR solutions, it reduces employee turnover.

- Access to a talent pool: A PEO provides access to a large talent pool. As a result, you can always find employees that meet your criteria. It eliminates the need to hire and train new employees when existing ones leave your business.

- Increased return on investment: The right PEO will make sure that its clients get value for their money by offering customized services based on client-specific needs. From identifying savings to providing access to a large pool of potential employees, PEOs help increase return on investment.

- Uniformity in hiring and firing: Businesses’ lack of uniformity in human resource functions is a significant problem. A PEO helps solve this problem by providing companies with well-developed HR policies and procedures. It ensures that hiring and firing practices are consistent across the organization.

- Improved employee engagement: PEOs help improve employee engagement by providing various services, including training and development programs. Employees are happier and work harder when provided with professional development opportunities.

- Compliance with regulations: Businesses that use PEO services don’t need to worry about complying with federal laws. A recent survey suggests that HR departments spend an average of 36 hours every week on compliance-related tasks. Using a PEO can reduce this time to just a few hours every week.

- Flexibility: Many PEO companies offer their clients flexibility in terms of the services they provide. A good PEO should help its clients grow by providing access to different HR solutions as their business changes. Non-core businesses should align with administrative service providers.

- Better benefits for employees: PEOs have the resources to offer significant benefits packages that include health insurance, dental insurance, and 401k plans. The Society for Human Resource Management argues that small and medium-sized businesses may find it challenging to provide competitive benefits due to limited budgets. Larger companies continue to increase benefits to attract the best talent available.

How to Compare PEOs

The PEO industry is quite competitive. As a result, many PEOs aggressively offer incentives to attract new clients. However, small business owners need to compare each PEO’s services before carefully deciding.

Services Offered

It makes sense to take your time and explore all available options when choosing between different PEOs. Compare the services offered by different PEOs before you sign a contract. You should also compare costs and other terms associated with various PEOs to make sure that you’re getting the best deal for your business.

Cost

The cost of hiring a PEO is not the same for all businesses. A PEO’s costs depend on several factors, including the number of employees your business has, your industry, and the services you want the PEO to provide. Make sure you understand all the costs of using a PEO before signing any contracts.

Flexibility

There’s no one size fits all solution when it comes to PEOs. Many PEOs often apply the same services to all businesses, regardless of their size or industry. This strategy often fails, and that’s why it’s crucial to select a PEO that offers a tailored approach to meet the unique needs of your business.

Comprehensive System

A good PEO should provide your business with a comprehensive system that covers all areas of HR, from recruiting and onboarding to employee training and termination. When comparing these systems, make sure you understand how each system works and the level of support your PEO will offer.

Reputation

A PEO’s reputation and level of expertise can help you decide. Identify their company values, how they prioritize client satisfaction, and their familiarity with the laws governing HR. Be sure to understand if they have a strong customer service team and what types of training and development opportunities they offer their employees.

Industry Knowledge

PEOs that lack industry knowledge can’t provide accurate advice about running your business. To identify a PEO with a good understanding of your industry, you should ask them about their experience and find out if they have worked with companies in your sector. Let them know that you’re looking for a partner to help you grow and scale your business.

Employment Practices and Liability Insurance (EPLI)

EPLI protects your business from discrimination claims and lawsuits. A good PEO should have a comprehensive EPLI insurance policy to cover employees, clients, and subcontractors. Consider the level of ownership interest the PEO will have in your business in case of a claim. Note that some PEOs offer different levels of EPLI.

The Best PEO Service Providers You Should Consider

The Best PEO services are those that can provide your small or medium-sized business with a comprehensive system that covers all areas of HR, from recruiting and onboarding to employee training and termination. While the costs vary, companies should select a PEO system that offers competitive rates and tailored services.

Below is an in-depth analysis of the leading PEO companies you should consider.

Best Overall: ADP TotalSource

ADP TotalSource is the leading PEO for businesses with less than 1000 employees. It’s a full-featured HR solution that offers a comprehensive system for businesses of all sizes. I recommend ADP TotalSource as the best overall PEO because of its flexibility. ADP can tailor its services to meet the specific needs of your business.

With more than 70 years of experience in the HR industry, ADP understands all aspects of payroll processing and compliance. It’s a scalable service that can support businesses of any size – from startups to large enterprises. Certified by the ESAC and IRS, only a few PEOs can match the industry reputation of ADP TotalSource.

ADP Totalsource is best for businesses that expect to grow, those with industry-specific needs, and companies that operate in high-profit margin industries. It offers custom pricing and flexible terms, but the starting rate is $85 per employee.

Other services offered by ADP TotalSource include:

- Onboarding solution for employees.

- A complete system to manage payroll, taxes, benefits, compliance, and more.

- Employee benefits (401k plans )

- Workplace safety resources

- HR consulting and support.

Pros

- 24/7 support

- Helpful specialists

- Online guides

- Easy to use

- Excellent compliance

Cons

- Reports are difficult to customize

- Pricey for some small businesses

- Occasional long waits when contacting support

Capterra Rating: 4.3/5 (191 reviews)

Despite a few negatives, ADP TotalSource is the best overall PEO service for businesses of all sizes. ADP TotalSource will help new users move over to its platform with onboarding specialists available 24/7.

The software is easy to use and navigate, but it’s also packed with features and functionality that appeal to any business. Overall, ADP is a reliable and robust service with an excellent compliance record.

Best for Startups: Paychex Flex

Paychex Flex is an established player in the PEO market. It stands out as an excellent option for startups because of its affordable pricing and excellent services. Paychex doesn’t offer its services as a middle man. Instead, it provides a comprehensive direct engagement with employees.

Depending on the needs of your business, you can opt for a single service or a complete PEO system. The flexible offering includes everything from payroll to HR, training, onboarding, and more. Online tools make it easy to manage your business, while on-demand support provides peace of mind.

Other services provided by Paychex Flex include:

- Fully compliant payroll services.

- Employee benefits (401k plans, health insurance, and more).

- Insurance services (health, life, dental).

- HR consulting and support

- Retirement services

Pros

- It puts you in control of your HR system

- Available online resources and guides

- Affordable

- Scaling is possible

- Onsite HR support (optional)

Cons

- Outdated system

G2 Rating: 4.2/5 (1313 Reviews)

Paychex addresses all facets of HR, from onboarding to retirement. While a strong choice for startups, it’s also a good option for companies that want a single service or a comprehensive PEO system.

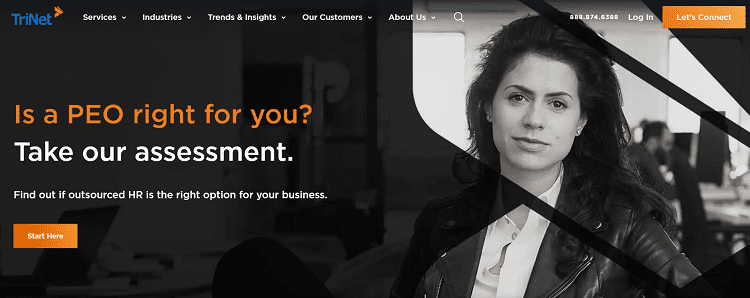

Best with Tailored Plans: TriNet PEO

TriNet is a PEO with customized HR services. The service focuses on creating an affordable program that meets the specific needs of your business. TriNet charges fees on a per-employee per month basis, with the option to customize services to match your needs.

Working with TriNet gives you access to HR best practices, health insurance, 401k plans, and employee benefits. TriNet provides excellent customer support, focusing on client education and satisfaction. Implementing TriNet PEO into your business is a straightforward process requiring little effort.

Other services provided by TriNet include:

- Payroll processing and Taxes

- Employee benefits (health insurance, 401k plans, and more).

- HR consulting and support

- Risk management and compliance

- Training and development

Pros

- Customizable services to meet your specific needs

- Excellent customer service

- Straightforward implementation process

Cons

- Only offers bundled services

G2 Rating: 4.0/5 (498 reviews)

Tailored services are ideal for growing businesses. Industries such as Architecture, consulting, Healthcare, life sciences, and engineering require flexible HR services. A representative will work with you to fully incorporate TriNet PEO, so your business is fully compliant.

Best for Small Businesses: Justworks

Justworks is a PEO for small businesses. It’s an affordable and easy-to-use service that helps you manage employee benefits, payroll, and compliance, among other services. It boasts more than 70,000 employees with a high customer satisfaction rate.

Justworks features an intuitive user interface, making it easy to navigate services. It also helps you stay compliant with tax filings and reporting. The design of the system makes scaling a straightforward process.

Other services provided by JustWorks include:

- HR consulting and support

- Tax compliance

- Employee benefits

- Compliance assistance

- Healthcare administration (medical insurance)

- Payroll processing and Taxes

Pros

- Ease of use

- Affordable

- Compliance assistance

- Excellent customer support

Cons

- Limited integration capabilities

G2 Rating: 4.6/5 (151 reviews)

Justworks is an excellent choice for small businesses. It’s affordable, easy to use, and provides many features to help you manage your employees. Justworks also offers extensive customer support to help you make the most of the service.

Best for Large Business: Infiniti HR

Infiniti HR is a comprehensive PEO service for businesses of all sizes. The service offers a wide range of features, including payroll processing, benefits, and HR consulting. It ranks as the best PEO service for large businesses because it was the pioneer PEO with franchise and hotel management experience.

Infiniti HR allows customization of services to meet the specific needs of your business. You can also choose from various add-on services, such as background checks and drug screening. The service offers excellent scalability, making it ideal for expanding or contracting businesses.

Infiniti HR also provides:

- Employee benefits

- Payroll processing and Taxes

- Healthcare administration (medical insurance)

- 401(k) and retirement services

- Compliance support

Pros

- Online training resources

- Customer support team

- Scalable services to meet varying needs

- Franchise and hotel management experience

Cons

- No clear pricing structure for services

Infiniti HR is the best PEO service for large businesses. It was an innovator with experience in franchise and hotel management. Their wide range of services is ideal for large companies and allows for scalability to match the needs of your business.

Criteria of Selecting the Best PEO Services

When selecting the best PEO services, I considered the following criteria.

- Integration: Is the service capable of integrating with your existing business management tools? Does it have any integrations beyond payroll, taxes, and employee benefits?

- Customer support: How easy is it to contact customer support? Do they offer self-service documentation or detailed knowledgebase articles? How fast does customer support respond?

- Size of company/business type: Is the service suitable for any size of business or only certain business types? What are the limitations of the service, if any? What do they offer for each industry?

- Price: How does the pricing of the service compare with similar services? What are all of the costs and fees associated with the service? Is there a free version available?

- Features: What features does that PEO offer? How many integrations or add-ons does the PEO offer (background checks, drug screenings, etc.)?

- Ease of use: How easy is it to sign up for the service? How easy is it to get started with the features of the PEO? Is there a mobile app available?

While the services I selected offered many of these features, one service may be better suited to your business than another. By considering the criteria above and determining which features are most important to your company, you can easily find the best PEO service.

The Role of Brokers in Finding the Best PEO Services

Brokers play a significant role in helping you find the best PEO services. While it may seem more convenient to sign up for a service by yourself, using a broker can save time and money on your part. A broker will work with many different companies to help you find the ideal solution for your business needs.

Brokers work with multiple companies and know which services best match your situation. They will work to negotiate a price that saves you money. Brokerage service providers like NetPEO, for example, offer a complimentary PEO comparison service.

A PEO broker could be a group of individuals or a company that has all the skills and knowledge necessary to help you find the best PEO services. Some brokers have backgrounds in accounting, insurance, or HR administration. They possess a thorough understanding of your business needs from a PEO service.

How to Find the Best PEO Services (FAQs)

Answer: Some of the questions to ask a PEO include:

-What are the company’s core values?

-How long has the company been in business?

-Do they have experience in my industry?

-What is the company’s cancellation policy?

-Are they licensed and insured?

-What are their fees, and how are they structured?

-Can I get a free trial of their service?

-What is the time frame for implementation?

-What kind of software or technology do they use?

-What type of support do they offer?

Answer: Some of the disadvantages of using a PEO include:

-Loss of control over essential HR functions

-Culture influence and changes

-Increased administrative burden

-Potential for increased liability

Answer: A PEO may or may not be a joint employer. A PEO is not a joint employer if it only provides payroll and HR administrative services. However, if a PEO offers other services such as management, training, or supervision, the PEO may be a joint employer.

Either way, it’s essential to consult an employment lawyer to determine if a PEO is the right fit for your business.

Answer: The main difference between a PEO and an HR outsourcing provider is that a PEO is a full-service HR provider. An HR outsourcing provider typically only provides payroll and HR administrative services. However, both PEOs and HR outsourcing providers can provide excellent value to your business.

Answer: Some of the benefits of a PEO include:

The benefits of using a PEO include:

-Reduced risk of litigation

-Access to comprehensive employee benefits

-Increased HR efficiency

-Access to a professional management team

-Increased productivity and the potential for improved margins

Answer: The best PEO service provider is ADP TotalSource, it offers a range of services that are customizable to your specific needs, has an excellent reputation, and it’s affordable. Other PEOs include TriNet PEO, Paychex Flex, and Insperity. However, it’s essential to research each provider to find the one that best matches your business needs.

Conclusion

It’s essential to research each provider thoroughly before committing your business to a PEO. The best PEO service providers are flexible, affordable, and have an excellent reputation. You can find the right company for you by asking them about their core values or if they have experience in your industry.

You can also get a free trial of their service to see if it’s a good fit for your business. The best way to find a PEO is through a broker. A broker will work with multiple providers and help negotiate a price that saves you money. However, it’s essential to consult an employment lawyer before signing a contract with any PEO.