- Oregon Payroll Tax and Registration Guide - December 16, 2021

- Utah Payroll Tax and Registration Guide - December 4, 2021

- Texas Payroll Tax and Registration Guide - December 4, 2021

Aside from being an attractive retirement location, Florida is also one of the most exciting destinations for small businesses. I’ve put together this Florida payroll tax and registration guide for new business owners to make filling and reporting taxes easier for them.

At the moment, there are more than 2.7 million small businesses in Florida, and a favorable taxation system is a key reason why so many local and international entrepreneurs decide to register their organizations in this state.

Florida doesn’t impose state income taxes on business owners, which lowers the business’s expenses and makes it easier to calculate employee tax withholdings. In this guide, I am going to show you how to withhold taxes for each employee on your payroll.

Registering a Business in Florida

Although Florida doesn’t have the state income tax, it does have the corporate income tax that applies to limited liability companies, partnerships classified as LLCs, political organizations, as well as all types of corporations, including S corporations.

This tax doesn’t apply to individuals, so you won’t have to include it in the amount you’re withholding from your employees’ wages. Nonetheless, the business structure you choose will determine how much you’ll have to spend on state and federal payroll tax every month.

All businesses in this state must be registered with the Florida Department of State and the Florida Department of Revenue. In addition, some businesses need licenses and permits to perform commercial activities within specific industries.

City and county governments may also require different types of permits and licenses, so you must check the regulations and obtain the necessary documentation to complete the business registration process successfully.

Obtaining the Employer Identification Number

The next step you need to take after registering your business is to apply for the employer identification number. The IRS issues this nine-digit number, and it serves as an equivalent of a person’s social security number.

Acquiring EIN isn’t mandatory for all organizations, although businesses that don’t have this number may have trouble opening a bank account or receiving payments from their clients.

Business owners can apply for this number in several different ways, but they can only get their EIN instantly if they complete the application process online. Alternatively, the application can be submitted by mail, but in this case, a business owner must fill out the SS-4 form.

This number is only assigned to a business once, and you won’t be able to change it unless the organization meets the necessary requirements. Inheriting EIN from the previous business owner isn’t possible, and you have to obtain a new one after you purchase a business.

Acquiring the Florida Reemployment Tax Account Number

The fastest way to obtain the Florida reemployment tax account is to complete the registration process on the Florida Department of Revenue website. You’ll be required to provide the organization’s EIN, so you won’t be able to complete the registration before you obtain this number from the IRS.

You can apply for the RT account number by mail, in which case you have to submit the DR-1 form with your application. In addition, a business must meet the following conditions to become eligible for the state’s reemployment tax.

- Your business has one or more employees for one day or less during 20 weeks.

- Business’ quarterly payroll exceeds $1,500

- Eligibility for FUTA taxes

In addition, if a business purchases another business that is eligible for federal or Florida state reemployment tax, it becomes responsible for the costs of these federal and state taxes.

This tax is deposited to the Unemployment Compensation Trust Fund and is used to pay reemployment assistance benefits to suitable candidates.

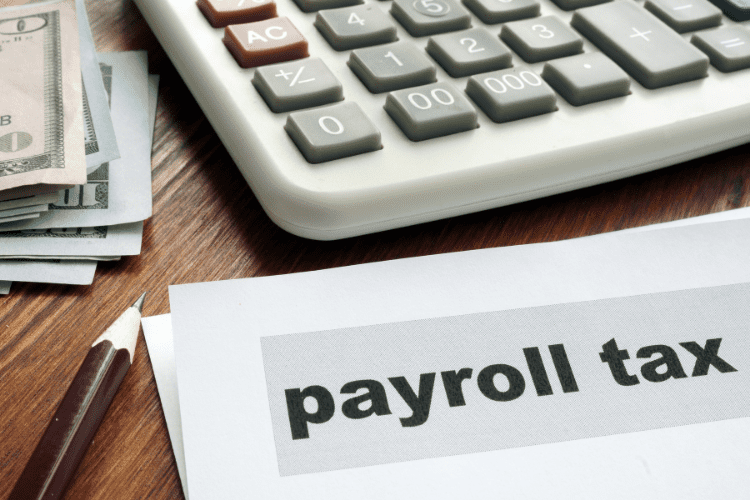

Understanding the Florida Payroll Tax

Florida doesn’t have the state income tax, but it has a variety of other taxes that can affect the price of an organization’s services or payroll tax expenses. For example, the flat rate of 4.5% corporate income tax applies to LLCs, certain types of partnerships, and corporations.

The business pays this tax, and it can’t be covered by employees. The same is true for both state and federal unemployment taxes that are the sole responsibility of employers.

All businesses based in Florida have to withhold the federal income tax and FICA taxes from the wages of each of their employees.

Hence, business owners in Florida have the same payroll tax responsibilities as business owners in all other states. The base wages and percentages used to calculate these taxes are adjusted every year, so the withholding tax amount may increase or decrease at the beginning of a new fiscal year.

Gathering the Employee Tax Withdrawal Documentation

All businesses must report a new employee within the first 20 days of the hire’s employment period to the Florida State Directory of New Hires. This legislation applies to businesses of all sizes, and it includes private contractors that receive more than $600 per year from an organization.

Besides registering a new hire, you also have to obtain several documents from an employee before their employment period can start.

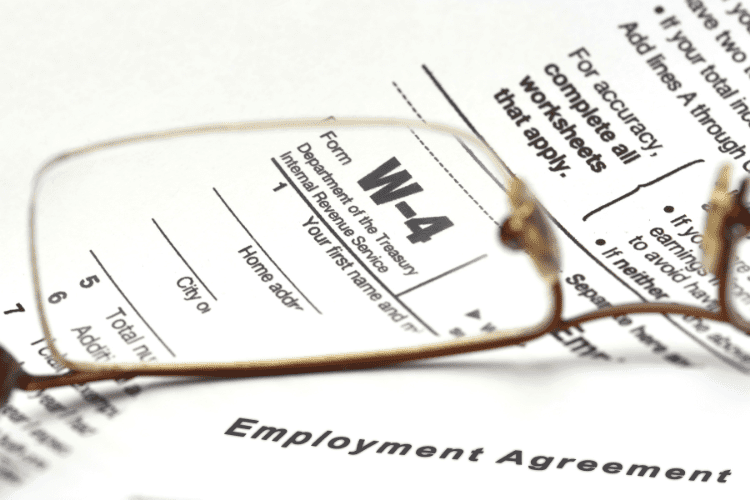

W-4 Form

The employee’s withholding certificate contains the information employees use to calculate the tax withholdings. So, a new hire has to choose if they want to file income taxes separately or jointly with their partners, declare how many jobs they currently have, and claim the number of dependents.

Keep in mind that this form can only be used to calculate federal payroll taxes. Employers can download the W-4 form from the IRS website, and they’re required by the law to ask a new employee to complete this document on their first day of work.

All information provided in the W-4 form is confidential, and the document remains in the employee’s file.

I-9 Form

Businesses cannot hire employees who don’t have the authorization to work on the territory of the United States. That’s why all new hires have to submit the I-9 form that proves their eligibility to work in the State of Florida or anywhere else in the U.S.

Employees are also required to provide a valid document that proves their identity and employment authorization. Employers should keep the I-9 form for three years after the employment period starts, and they have to present it to the authorities if requested to do so.

Direct Deposit Authorization

You’ll only have to obtain this document from future employees if they decide to have their wages deposited into their bank accounts. Besides providing account and routing numbers, new employees have to submit a voided check with the direct deposit authorization form.

You can find this document on the Florida Department of Financial Service’s website.

Calculating the Payroll Tax

Businesses based in Florida don’t have to withhold the state income tax from wages, as mandatory payroll taxes in this state are on the federal level. Employers can find almost all the information they need to calculate the payroll tax for their employees in the W-4 form.

Moreover, the state’s reemployment tax applies only to employers, and it cannot be deducted from the employee’s pay. That’s why employers in Florida shouldn’t have a hard time determining the tax withholdings for their employees.

Let’s take a look at what you need to do to calculate the Florida payroll tax.

Gross Pay and Pre-Tax Withholdings

The first thing you need to do is determine an employee’s gross pay. This process is slightly different for part-time hires or independent contractors and salaried employees.

To calculate the gross pay of a part-time worker, you need to know their hourly rate and the number of hours they worked between two payment periods. Once you have this information, you should simply multiply two values to determine the gross pay.

This process gets slightly more complicated if a part-time employee has worked overtime because the hourly rate increases by 1.5 times. The gross pay of a salaried employee is calculated by dividing their annual pay by the number of payment periods in a fiscal year.

You should deduct any pre-tax withholdings an employee might have and use the remaining amount to calculate the federal payroll taxes.

Federal Payroll Taxes

The withholding method and federal payroll tax rates depend on the information an employee provided in the W-4 form. The IRS offers guidelines on how to determine the withholding amount based on the employee’s annual income, marital status, and other factors.

Federal payroll taxes are not the same every year, and you need to check the latest adjustments before the beginning of a new fiscal year. Employers in all states, including Florida, must withhold FICA and federal income taxes from the salaries of each employee on their payroll.

Federal Income Tax

The annual gross salary, tax filing method, or the number of dependents are some of the factors that can help you determine the federal income tax for an employee. This tax varies from 0% to 37%, so you must check the appropriate withholding method for each employee.

You can use the IRS publication 15-T if you need further assistance to pinpoint the federal income tax brackets and rates for workers on your payroll.

FICA Taxes

The social security and Medicare taxes are covered by the FICA taxes. All employers must withhold 6.2% of the wages for social security tax, but only until an employee reaches the $142,800 annual income threshold.

The Medicare tax is calculated at the rate of 1.45% for all wages below the $200,000 mark, while the additional Medicare 0.9% tax applies to salaries above this threshold. However, the additional Medicare isn’t deducted from an employee’s pay since it is included in the employer’s payroll tax expenses.

Keep in mind that the taxable sum for social security tax isn’t fixed, and you need to check the taxable maximum for a new fiscal year.

State Payroll Taxes

Businesses in Florida don’t have to withdraw state income tax from the wages of their employees, and they’re only required to file for reemployment tax. This tax isn’t deducted from an employee’s wage. Hence, it doesn’t affect the amount you’ll have to deposit to an employee’s account.

Differentiating Between Federal and State Unemployment Taxes

The federal and Florida state reemployment taxes are similar, in a sense that businesses have to meet the same criteria to be eligible for these taxes. The FUTA tax is calculated at the rate of 6% for the first $7,000 an employee earns in a year.

The Florida reemployment tax also applies until an employee earns more than $7,000, but the rate at which the tax is calculated isn’t fixed. New employers are usually assigned a 2.7% reemployment tax rate, and the rate is revised after a business submits ten quarterly reports.

Afterward, the Department of Revenue calculates a new rate based on the benefits charged to an account and the reported taxable payroll. The minimum reemployment tax in Florida is limited to 0.1%, while the maximum rate can’t exceed 5.4%.

Employers who pay state unemployment taxes regularly may be eligible for FUTA tax reductions up to 5.4%.

Employer Payroll Taxes

Businesses are required to match the FICA taxes for all of their employees, which means that they have to contribute 6.2% for social security tax and 1.45% for Medicare tax. Employers also have to pay 0.9% of an employee’s wage for the additional Medicare tax for all salaries above $200,000.

Both federal and state unemployment taxes are the sole responsibility of the employer, and businesses cannot withhold these taxes from the wages of their employees. In addition, some organizations may be eligible for the Florida corporate income tax at rates that vary from 3.5% to 5.5% of the business’s total annual income.

Filing Taxes to IRS and Florida Department of Revenue

The frequency at which Florida-based businesses must file taxes to the IRS depends on the withheld tax amounts.

In most cases, organizations can choose between semiweekly and monthly filing periods, and depending on the schedule they choose, they have to use the form 941, 943, 944, or 944 while filing for quarterly or annual tax returns.

Form 940 is used to file annual reports for FUTA taxes. The IRS encourages employers to file taxes through the electronic fund transfer system, although businesses can choose to file payroll taxes by mail.

Employers have to submit the W-2 form wage and tax statement to this tax authority at the end of every fiscal year. The Florida reemployment tax is paid quarterly to the Department of Revenue, and it is filed together with the RT-6 quarterly report.

Businesses can submit the required documents and make payments through the File and Pay webpage at the Florida DOR website.

Frequently Asked Questions About Florida Payroll Taxes and Registration

Answer: Yes, but only for the first three quarters. Employers can only pay reemployment tax in installments if all payments are made on time and if the wage data is accurate.

Answer: Yes, the payroll tax is mandatory for all organization’s employees, including part-time workers or independent contractors.

Answer: Employers receive an online confirmation number after completing the reemployment tax account registration process. They’re required to contact the FL DOR after three business days to obtain the account number and information about the tax rate.

Answer: Yes, it is, but only if your business offers taxable services or goods.

Final Thoughts

The costs of running a business in Florida aren’t too steep, partially because the state doesn’t have an income tax. Hence, the majority of payroll taxes comes from federal taxes, while the only state taxes business owners must cover is the reemployment tax.

The state imposes the corporate tax on corporations, LLCs, and some types of partnerships, so the business structure you choose might increase the amount you have to spend on payroll taxes every month.

Calculating payroll tax for Florida-based businesses isn’t difficult because federal and state tax authorities offer clear instructions on how to complete this process. Was the Florida payroll tax and registration guide useful? Let me know in the comments.

Further readings: