- Oregon Payroll Tax and Registration Guide - December 16, 2021

- Utah Payroll Tax and Registration Guide - December 4, 2021

- Texas Payroll Tax and Registration Guide - December 4, 2021

Statistics indicate that the small business market in North Carolina has been booming since 133,000 new employer identification numbers were issued in 2020. This North Carolina payroll tax and registration guide will provide you with the information you need to join thousands of the state’s small businesses.

Filing payroll taxes in North Carolina isn’t difficult, but you still have to know which state and federal tax regulations apply to your business. Besides, the business structure you choose or the years of the organization’s experience affect the tax withholding rate that applies to your employees.

So, in this guide, I’m going to walk you through the most important aspects of registering employees and calculating the payroll tax for each new hire.

Registering a Business in North Carolina

Back in 2015, more than 1.6 million or almost 15% of the state’s residents were employed by small businesses.

The number of registered businesses in North Carolina has increased in the meantime, which means that organizations with fewer than 500 employees constitute a significant portion of the state’s economy.

New businesses have to be registered with the North Carolina Secretary of State office unless you’re registering a sole proprietorship or a general partnership, in which case you will have to submit the required documents to the Register of Deeds office in the county where the business will be operating.

The exact steps you need to take during the registration process depending on the business structure you choose. The State of North Carolina requires you to have the necessary licenses and permits for specific business activities.

The Secretary of State Office issues more than 700 occupational and regulatory licenses and permits, so you have to find out which permits or licenses you have to acquire to start a business in a particular industry.

All new business owners can contact the Business Link North Carolina organization set up in partnership with the NC’s Department of Commerce for a free consultation regarding the requirements they need to meet to get their business off the ground.

Obtaining the Employer Identification Number

The business registration process usually takes 10 to 15 days. Once this process is completed, you can proceed to apply for the Employer Identification Number. The IRS issues this number, and you’re not required to obtain it if you’re running an organization that doesn’t have employees.

However, acquiring EIN can be useful even for sole proprietorship businesses because it might make it easier for them to open a bank account for a business or receive payments from clients. You won’t have to submit any documents besides a valid taxpayer identification number if you decide to apply for EIN online.

You’ll be required to fill out the SS-4 form if you opt to submit your application via fax or mail. The IRS offers detailed instructions on employer tax responsibilities in Publication 15 that is available on their website.

Acquiring the Department of Revenue and Employment Security Account Numbers

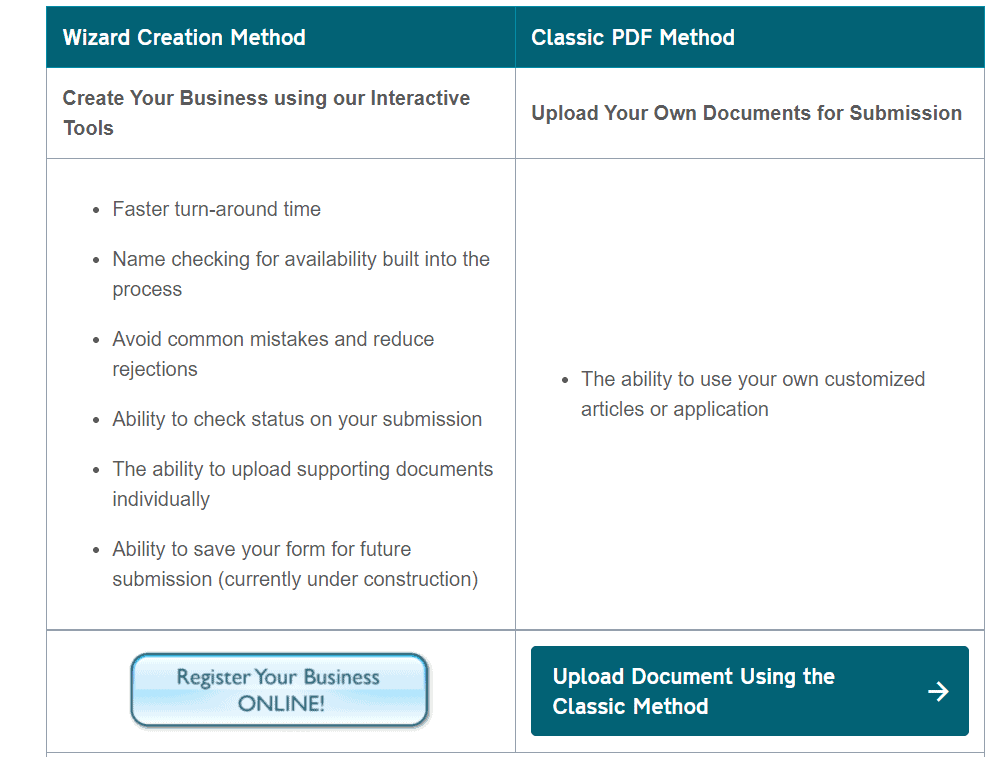

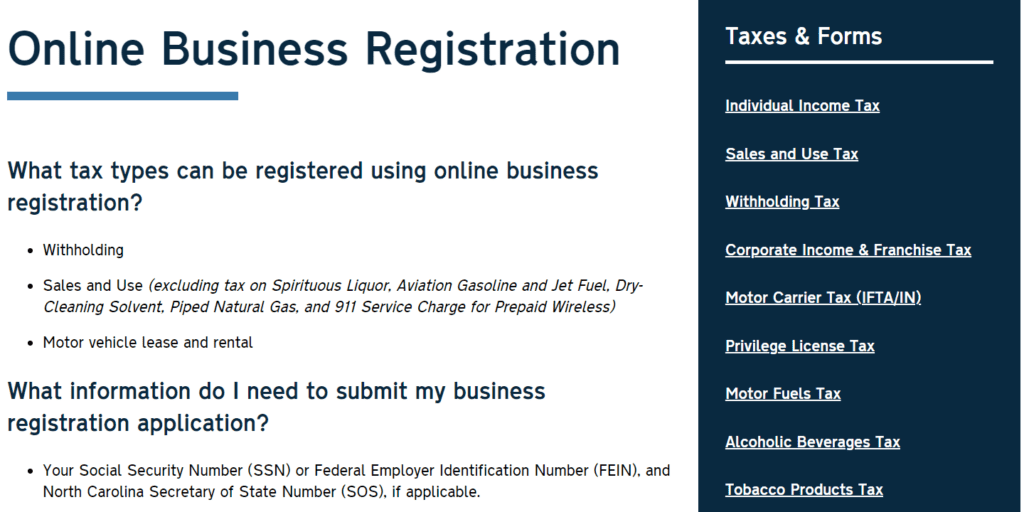

Filing for state payroll taxes in North Carolina is impossible with the Department of Revenue and Employment Security account numbers. The NC DOR account ID is a 9-digit number assigned to new employers immediately after the online registration process is completed.

You cannot obtain the NC DOR account ID before you acquire the EIN for your business, as you will be required to submit the organization’s EIN during the registration process. You’re also going to need a valid social security number and, in some cases, the North Carolina Secretary of State number.

It is important to remember that LLC or corporations have to obtain the NC Secretary of State ID or SOSID that is assigned to them after registering the business at the Secretary of State office before they can acquire the NC DOR account ID.

Before applying for the Employment Security account number, you must first get the employer tax account number (EAN) issued by North Carolina’s Division of Employment Security.

It usually takes four to six weeks to obtain the EAN, and you’ll have to wait until it is assigned to your organization and then use it to apply for the NC Employment Security account number.

Understanding the North Carolina Payroll Tax

All businesses registered with North Carolina’s Secretary of State or local Register of Deeds offices are required to file for federal and state payroll taxes.

North Carolina is one of ten states that has a flat rate state income tax, which means that you won’t have to calculate the tax withholdings based on salary levels.

The state doesn’t have local income taxes, but it requires all employers to cover the expenses of the state unemployment insurance that applies to the taxable base wage. Moreover, employers also have to cover FUTA taxes and withhold FICA and federal income taxes.

Both state and federal payroll taxes are adjusted annually, and employers must keep in touch with the latest changes in order to know how to calculate the amount they should withhold from salaries they pay to their employees.

Gathering the Necessary Documents

Employers in North Carolina can’t pay wages to newly hired employees unless they provide the documents that enable the employer to calculate the federal and state tax withholdings.

These documents are usually submitted before the employment period starts or within the first few days of employment. Employers must report a newly hired employee to the NC New Hire Directory within 20 days after the employment period begins.

Let’s take a look at the documents employers in North Carolina have to acquire from their employees.

W-4 Form

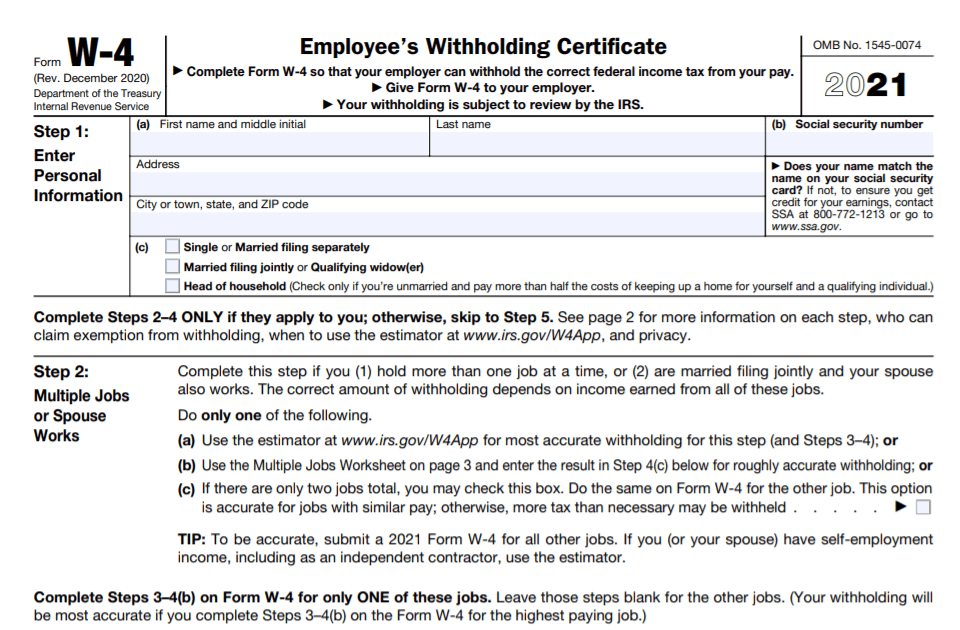

The employee’s withholding certificate or the W-4 form contains the information employers use to calculate the federal tax withholdings. The form can be obtained from the IRS website along with the instructions on how it should be filled out.

Employees can use this form to declare dependents, choose if they want to file jointly with their partners or separately, and specify if they have additional sources of income. The employer uses this information to choose the appropriate tax withholding method for each of their employees.

Data provided in the W-4 form are confidential, and employers can’t share it with the tax authorities unless they’re requested to do so.

NC-4 or NC-4 EZ

The NC-4 and NC-4 EZ forms are the state-level equivalents of the W-4 form, as they’re used to calculate the state payroll tax. The information they contain is very similar to the data in the W-4 form.

Hence, an employee must decide if they want to file taxes as a single or married person and declare additional sources of income. Arguably, the biggest difference between the NC-4 and W-4 forms is the Allowance Worksheet that includes information regarding the pre-tax deductions.

I-9 form

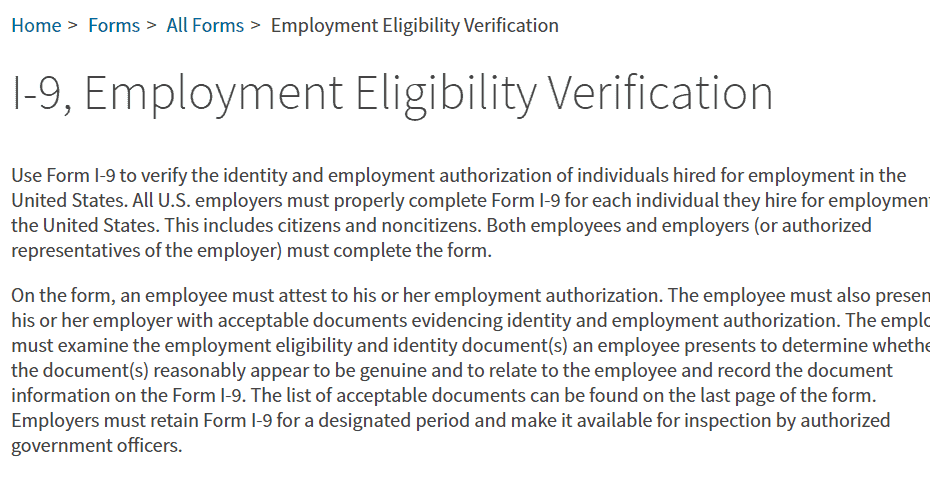

A new employee must be able to present the proof of their eligibility to work on the territory of the United States before they can start working for a North Carolina-based business. What’s more, all employers are required to ask their new hires to fill out the I-9 form before the first day of work.

Besides this form, employees must also submit a valid document, such as a passport, ID, or driver’s license, that proves their identity.

Direct deposit authorization

The vast majority of employees prefer to have their wages deposited into their bank accounts. Therefore, the direct deposit authorization form grants an employer permission to deposit wages to the employee’s bank account.

Aside from personal data, an employee should attach a photocopy of a valid check or a voided check along with a blank form that contains the account and routing numbers.

Calculating the payroll tax

The process of deducting taxes is slightly different for each employee as their marital statuses or additional sources of income aren’t the same. The IRS and North Carolina Department of Revenue provide detailed guidelines that enable employers to calculate the state and federal payroll taxes.

It is worth adding that both of these tax authorities adjust payroll tax rates annually, so employers must check the rates at which they calculate payroll taxes before the start of every fiscal year. Here’s how you can calculate the payroll tax for your employees

Gross Pay Calculation

The method you’re going to use to calculate an employee’s gross pay depends on the type of contract they have. Part-time or freelance employees usually work for an hourly fee, so to calculate their gross pay, you have to multiply the number of hours they’ve worked in a week by the hourly fee.

The hourly fee for overtime hours is usually 1.5 times higher than the regular rate, so you must calculate all overtime hours at the agreed rate. Most full-time contract employees usually receive their wages semiweekly or monthly.

So, to calculate their gross pay, you just have to divide their annual salary by the number of payment periods in a fiscal year.

You should remember to withhold all pre-tax deductions such as dental insurance, childcare expenses, or retirement funds from the gross pay before calculating the employee’s payroll taxes.

Withholding Federal Payroll Taxes

All businesses based in North Carolina must file payroll taxes to the IRS for each of their employees. This tax authority provides a set of guidelines on how to calculate the federal income, FICA, and FUTA taxes.

Keep in mind that the rates for these taxes aren’t the same, and they depend on factors like the employee’s annual salary or the applicable percentage method.

FICA Taxes

Federal Insurance Contributions Act includes social security and Medicare taxes. The social security tax of 6.2% only applies until an employee earns more than $142,800 in a year. The rest of the employee’s annual earnings is not subject to this tax.

The flat rate of 1,45% Medicare tax is withheld from all salaries up to $200,000. This tax increases to 2.35% for employees who earn more than $200,000 per year, although employers usually cover the additional tax.

Hence, the maximum FICA taxes a business can withhold from a salary can’t exceed 8.55% of the employee’s wage.

Federal Income Taxes

The IRS Publication 15-T percentage and wage bracket methods businesses can use to calculate federal income taxes. Companies based in North Carolina can choose the method that best fits the payroll system they’re using.

The rates for this tax span from 0% to 37% depending on the tax filing option the employee selected and various other factors.

FUTA Taxes

Federal unemployment taxes are calculated at the 6% rate for the first $7,000 of the employee’s annual salary. This tax can be reduced up to 5.4% by paying the North Carolina state unemployment tax. The tax credit is only available to employers who pay the state unemployment tax regularly and in full.

State and Local Payroll Taxes

The state income tax of 5.25% applies to all wages in North Carolina, regardless of the salary level. Local governments in North Carolina don’t impose income taxes on businesses operating under their jurisdiction.

Besides the state income tax, businesses based in this state also have to cover the state unemployment insurance tax that ranges from 0.06% to 5.76%. The maximum state tax withholding amount in North Carolina can’t exceed 11.01% of the employee’s gross wage.

Figuring Out Federal and State Unemployment Taxes

Both federal and state unemployment taxes are mandatory. The Division of Employment Security assigns most newly registered businesses in North Carolina the 1% unemployment tax rate.

Rates for this state tax is adjusted annually based on the employer’s reserve ratio percentage and experience rating. The rates vary from 0.06% to 5.76% of the determined base wage for the current year. The base wage is adjusted annually, and it is currently set at $26,000 of gross annual income.

As we already noted, filing state unemployment insurance taxes on time makes a business eligible for federal unemployment insurance tax reduction. Also, you must file the federal UI tax to the IRS, while the state UI tax is submitted to the North Carolina Division of Employment Security.

Employer’s Payroll Tax Expenses

Besides withholding the taxes from the wages, employers also have to cover payroll taxes that only apply to organizations. All employers in the United States are required to match the FICA taxes for each of their employees.

So, a business based in North Carolina has to pay 6.2% social security tax and 1.45% Medicare tax for every employee on their payroll. The business covers the additional Medicare tax for all salaries above $200,000.

Employers are responsible for the costs of the federal and state unemployment taxes and they cannot deduct this tax from the salaries of their employees.

Filing Taxes to the IRS and NC Department of Revenue

Businesses can choose if they want to file federal payroll taxes monthly or semiweekly at the beginning of the fiscal year. All tax deposits are made through the IRS’ electronic fund transfer system that allows you to file taxes in just a few clicks.

The North Carolina state payroll taxes can be filed semiweekly, monthly, or quarterly, depending on the amount a business withholds every month. Organizations that opt to file payroll taxes monthly or quarterly can do so by filling out the NC-5 form on the NC Department of Revenue website.

Businesses that file payroll taxes semiweekly must use the eNC5Q form that is available through the DOR’s Online Filing and Payments system. Filing taxes through the mail is also an option, but only for organizations that withhold less than$20,000 of payroll tax each month.

All companies that withhold more than $20,000 of monthly payroll tax must submit payments using the electronic funds transfer.

Businesses based in North Carolina have the legal obligation to submit the Annual Withholding Reconciliation or the NC-3 form along with W-2 and 1099 statements a month after the end of the fiscal year.

Frequently Asked Questions

Answer: No, IRS and North Carolina Department of Revenue issue both of these identification numbers for free.

Answer: Yes, you can file taxes by mail in North Carolina, but you will be required to make payments electronically if you withhold more than $20,000 of payroll tax every month.

Answer: Yes, all employees who work on the territory of North Carolina are subject to the state’s payroll tax, regardless of their residency status.

Answer: You can get a 5% to 25% penalty if you fail to submit a payroll tax report on time and a 10% penalty for failing to pay payroll taxes within the specified timeframe.

Final Thoughts

Even though most new businesses are assigned a 1% rate, determining the state unemployment tax rates is still the most challenging part of filing payroll taxes in North Carolina.

The state has a flat income tax rate that applies to all wage levels, so you won’t have to spend a lot of time calculating how much of the employee’s salary you should withhold for the state income taxes. Moreover, you can use the DOR’s N-30 guide to determine the exact withholding tax percentage.

Besides state payroll taxes, you also have to withhold federal income and FICA taxes from all wages you have on your payroll. Was this North Carolina payroll tax and registration guide useful? Share your opinions with me in the comments.

Further reading:

Florida Payroll Tax and Registration Guide: Understanding the Florida Payroll Tax