- Oregon Payroll Tax and Registration Guide - December 16, 2021

- Utah Payroll Tax and Registration Guide - December 4, 2021

- Texas Payroll Tax and Registration Guide - December 4, 2021

Texas is one of the nine states in the U.S that don’t have state or local income tax, but this doesn’t mean that Texas-based businesses are exempt from payroll tax. So, in this Texas payroll tax and registration guide, I’m going to provide you with the information you need to file state and federal taxes for each of your employees.

Currently, there are 1,787,607 small businesses in the state of Texas, but only 399,323 have more than one employee, while 1,388,284 organizations function as sole proprietorships.

Furthermore, this number doesn’t include all self-employed entrepreneurs, as there are more than a million incorporated companies or sole proprietorships without employees in the state.

All organizations in Texas that hire employees must deduct taxes from their salaries, and in this guide, I will show you what you need to do to calculate and file payroll taxes for your Texas-based business.

Registering a Business in Texas

The first thing you need to do before hiring employees is registered your company with the Texas Secretary of State office. You can choose to register a sole proprietorship, partnership, corporation, or LLC.

The documents you’ll have to submit depend on the business structure you choose, and you’ll have to cover a $300 fee to set up a corporation or a $200 fee per partner to start an LLC.

You don’t have to file organizational documents if you’re registering a sole proprietorship or a partnership, but in some cases, general partnerships businesses may be required to provide a written partnership agreement.

Obtaining the necessary regulatory permits and licenses is a mandatory step of the business registration process. Authorities on county or the city levels issue these documents, and the permits and licenses you’ll have to obtain depend on the industry you’re working in.

Moreover, you’re required to apply for a professional or occupational license from the Texas Department of Licensing and Regulation, while all businesses that offer professional services must obtain the Certificate of Authority from the Texas Secretary of State.

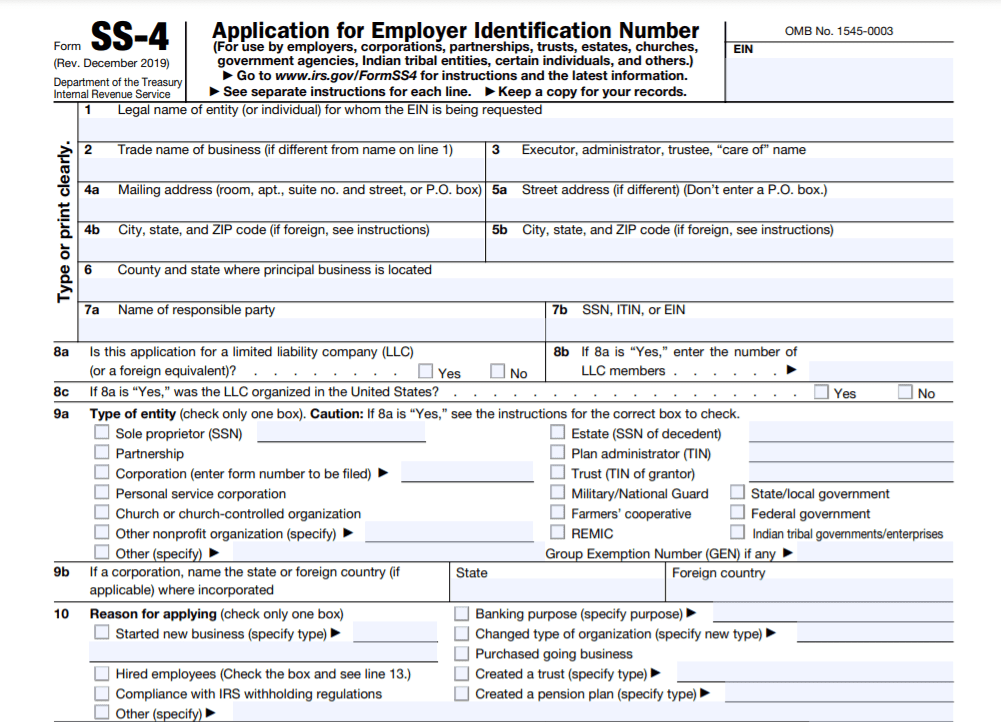

Obtaining the Employer Identification Number

You’re required to acquire the employer identification number if you plan to run a business that hires employees. Getting EIN can be beneficial even if you’re not legally obligated to do so since a bank may ask for this number to open an account for your business.

State authorities in Texas don’t issue employer identification numbers, and employers have to obtain this number from the IRS. You can apply for EIN online, via mail or fax, by submitting the SS-4 form. You should go through the instructions before you start filling out this form.

Also, you shouldn’t apply for EIN before you complete the business registration process. EIN doesn’t expire, so once this number is assigned to your organization, you will only be able to change it or obtain another one if the IRS determines that your business needs another EIN.

The process of acquiring this number usually lasts four weeks.

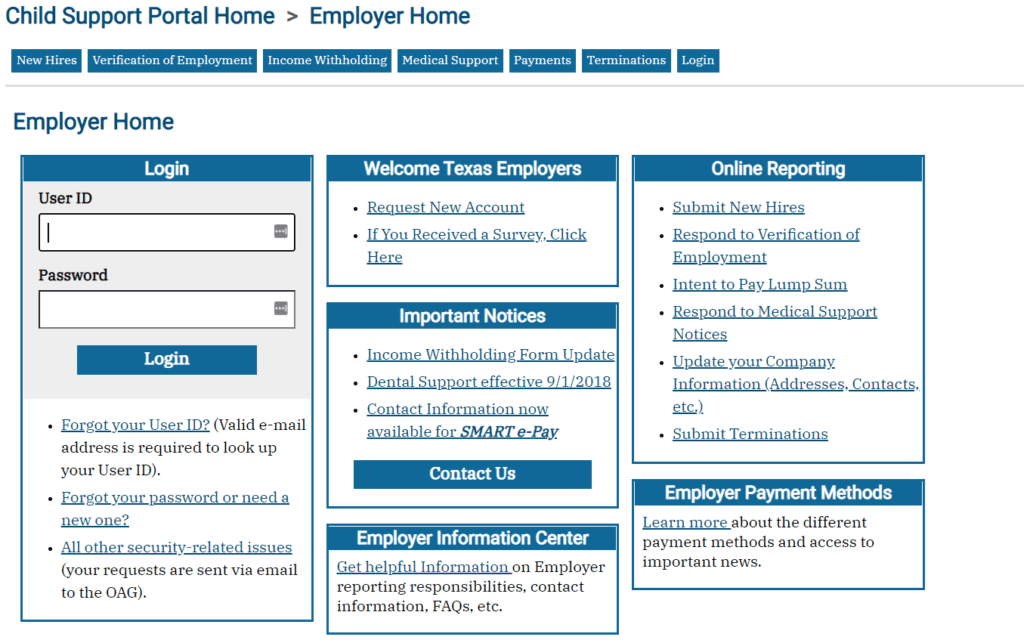

Registering the Tax ID Number and TWC Account Number

Once you’ve obtained the EIN for your business, you can proceed to get the Texas Workforce Commission account number. The tax ID number is usually used to file taxes on the state level, but since Texas doesn’t have the state payroll tax, the business’ EIN serves as the tax ID number.

Creating the TWC account number is a straightforward process that can be completed online. You just have to fill out the C-1 and the C-1FR forms to provide the information required to determine if your organization is required to pay unemployment benefits under the Texas Unemployment Compensation Act.

The account number will be assigned to your business automatically upon the completion of the registration process. During the registration, you’ll be asked to create the User ID and password for your employer’s TWC tax account number.

Make sure to remember this information, as you’re going to need it to access the account and settle unemployment tax for your employees.

Understanding Texas Payroll Tax

Business owners in Texas are not required to withhold state income taxes from the salaries of their employees. The only payroll tax that is mandatory in this state is the unemployment insurance tax that applies to the first $9,000 an employee earns in a fiscal year.

Furthermore, city and local governments don’t impose mandatory payroll taxes, although small business owners are required to cover the sales and use taxes. These taxes don’t affect the employees, as they’re the sole responsibility of employers.

Federal income taxes and FICA taxes that include social security and Medicare taxes are mandatory for all businesses based in Texas. The federal income tax ranges from 0 to 37% of an employee’s salary, depending on their current marital status or additional sources of income.

Combined FICA taxes cannot exceed 8.55% for employees that earn more than $200,000 per year, or 7.65% for salaries below the $132,900 threshold.

The social security tax only applies to the maximum taxable sum of $142,000, and it shouldn’t be withheld once an employee exceeds this amount in a fiscal year. The fixed-rate 1.45% Medicare tax applies to all paygrades, and it increases by 0.9% for salaries over $200,000.

Gathering the necessary documents

Each new employee that joins a Taxes-based company has to submit several documents that prove their eligibility to work on the territory of the United States, indicate their preferred method of payment, and provide the information the employer needs to calculate the tax withholding amount.

It’s also important to remember that all businesses are required to report a new employee within 20 days to the Employer New Hire Reporting Operations Center at the Texas Office of Attorney General.

An employer needs to ask a new employee to fill out the following documents before their employment period begins.

W-4 Form

Texas doesn’t have the so-called Employee’s Withholding Certificate or the W-4 form issued on the state level. Hence, an employer must obtain this form from the IRS and use it to determine how much of the employee’s salary should be withheld for the federal income tax.

Aside from personal data, employees are asked to provide information regarding their marital status, choose the preferred filing method and claim dependents.

The IRS revised this document in 2020, but employees hired before the revision are not required to fill out the new version of the W-4 form. This document remains with the employer and shouldn’t be submitted to the IRS.

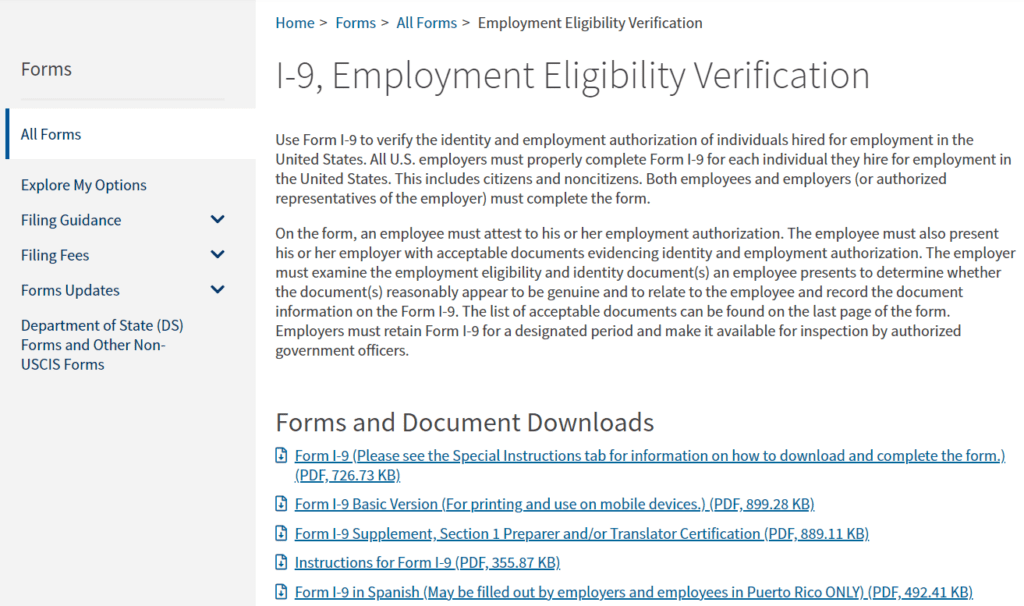

I-9 Form

Businesses in the United States cannot hire employees who are unable to verify their employment eligibility. The I-9 form is utilized to confirm the identity of a new employee and validate their employment authorization.

Besides the I-9 form, an employer can ask an employee to submit a copy of their passport, ID, or driver’s license as further proof of their eligibility to work. A new employee must fill out and submit this form before their employment period can start.

Authorization for Direct Deposit

This document is only necessary if an employee chooses to have their pay deposited to their bank account, and you won’t have to obtain it if an employee opts to be paid in cash, via paper check, or prepaid debit card.

The authorization for direct deposit serves as a permit for employers to deposit wages to an employee’s bank account. In addition to the bank name, account, and routing number, the employee should also provide a voided check for their bank account.

Calculating the payroll tax

Once you’ve obtained the necessary documents from an employee, you can use the information they provided to calculate the tax withholding amount.

The tax authorities offer guidelines for each step of this process, so it shouldn’t take you long to figure out how much of an employee’s salary should be deducted for taxes. Let’s take a look at the steps you need to take to calculate the payroll tax.

Assessing the Gross Pay

To calculate the gross pay of an hourly worker, you need to know how many hours they worked in a week. You can then multiply the number of work hours by their hourly rate and use the sum you end up with as their gross pay.

You shouldn’t forget to apply the appropriate rate for all overtime hours an employee has worked between two payment periods. To calculate the gross pay of salaried employees, you should divide their annual salary by the number of payment periods within a fiscal year.

Calculating the Federal Payroll Taxes

As a business owner based in Texas, you’ll have to withhold federal payroll taxes from your employees’ salaries. Federal payroll taxes include the federal income tax and FICA taxes. These taxes should be calculated after pre-tax withholdings were removed from the employee’s gross pay.

Employers can use wage bracket or percentage methods to determine the withholding tax amount. It’s worth noting that the federal payroll taxes are adjusted annually, so an employer must keep track of the latest payroll tax adjustments.

Federal Income Tax

The information an employee provides in the W-4 form serves as a guideline employers use to calculate the federal income tax. The IRS has a guide to Federal Income Tax Withholding Methods that can assist you in determining the appropriate method of withholding tax.

The Federal Income Tax rate ranges from 0 to 37%, and the rate you should use depends on the employee’s sources of income and several other factors.

FICA Taxes

Social security and Medicare taxes are mandatory in all states. Employees are required to withhold 6.2% of the employee’s salary for social security taxes.

This tax is only applied for the first $142,800 an employee earns in a fiscal year, and annual social security contributions cannot exceed the $8,853 threshold.

Employers have to withhold 1,45% of employees’ salaries to cover Medicare taxes. Additional Medicare Tax of 0.9% applies for annual salaries above $200,000, so you’ll have to deduct 2.35% of the employee’s wage on account of Medicare taxes.

Calculating the State and Local Payroll Taxes

As we already noted, Texas doesn’t have state income taxes. What’s more, city and local governments in Texas don’t require business owners to pay income taxes for their employees.

So, as a business owner in this state, you’ll only be required to cover federal payroll taxes and state unemployment insurance tax.

Paying the Unemployment Insurance

The unemployment insurance tax is the only state tax business owners in Texas have to cover. This tax depends on the following five factors.

- General Tax Rate

- Obligation Assessment

- Employment Training Investment Assessment

- Deficit Tax Rate

- Replenishment Tax Rate

These factors are used to determine the UI tax rate that varies from 0.31% to 6.3% of the employee’s salary. However, the tax only applies to the first $9,000 an employee makes in a fiscal year. In most cases, businesses are assigned a UI tax rate based on their experience.

Employer Payroll Tax Responsibilities

In addition to payroll tax responsibilities they have towards their employees, Texas-based businesses have tax responsibilities that apply only to their organization. All employers must match the FICA taxes and cover the same tax rate they withheld from an employee’s salary.

So, if you’re withholding 7.65% of the employee’s salary on account of FICA taxes, you’ll be required to match this rate and pay 15.3% of the salary for each of your employees.

Moreover, unemployment insurance can’t be deducted from the employee’s pay, and a business must cover the cost of this tax. Besides the state unemployment tax, a business also has to cover federal unemployment taxes at the rate of 6% of the first $7.000 an employee earns in a year.

FUTA taxes can be reduced by a maximum of 5.4% for businesses that meet the federal tax credit criteria.

Filing Taxes to the IRS and TWC

Employers can choose to file payroll taxes to the IRS either quarterly, monthly, or within two-week periods, depending on how frequently they issue payments to their employees.

They are required to submit the amounts withheld from the employee’s salary, as well as federal taxes that apply only to businesses. You’ll also be required to submit annual payroll tax reports to the IRS within a specified time frame.

The TWC issues the payment schedule for the unemployment insurance tax every year, and businesses must follow the latest updates in order to know how frequently they have to pay this state tax.

In addition, the TWC requires business owners to submit quarterly tax reports at set dates, and you may face penalties if you fail to meet these deadlines.

Frequently Asked Questions About Texas Payroll Tax and Registration

Answer: TWC assigns a fixed unemployment rate to all businesses, and newly registered businesses are usually assigned the rate of 2.7% of the employee’s wage.

Answer: Although employers in Texas are not under a legal obligation to offer paid time off, those businesses that do offer PTO are required to withhold taxes from all PTO payments.

Answer: Yes, you can. You just have to log in to your TWC account and process payments for each of your employees from the Payments tab.

Answer: No, new hire reporting refers to a one-time process of reporting a new hire, while the quarterly wage reporting involves filling the C-3 form either by post or electronically.

Final Thoughts

Texas generates most of its tax revenue through sales and uses tax that enables a business to sell or rent taxable property and services. Consequently, businesses are not required to pay income tax on state, city, or local levels.

The only state tax a Texas-based business has to cover is the unemployment insurance tax that ranges from 0.37% to 6.3% of the first $9.000 an employee earns in a year. All businesses working on the territory of Texas are required to file federal income, FUTA, and FICA taxes directly to the IRS.

Was this Texas payroll tax and registration guide useful? Let me know in the comments.